Temporary accounts are income statement accounts that are used to track accounting activity during an accounting period. For example, the revenues account records the amount of revenues earned during an accounting period—not during the life of the finance company. We don’t want the 2015 revenue account to show 2014 revenue numbers. Temporary accounts differ from permanent accounts, which do not need to be opened and closed each period as they show the ongoing financial position of a business.

Transfer Journal Entries to the General Ledger

The second entry closes expense accounts to the Income Summary account. The third entry closes the Income Summary account to Retained Earnings. The fourth entry closes the Dividends account to Retained Earnings. The information needed to prepare closing entries comes from the adjusted trial balance.

What Does It Mean to Close the Books?

In order to produce more timely information some businesses issue financial statements for periods shorter than a full fiscal or calendar year. Such periods are referred to as interim periods and the accounts produced as interim financial statements. Interim periods are usually monthly, quarterly, or half-yearly. When you close the books monthly, that means you make journal entries to ensure all transactions for the month have been captured.

How to close revenue accounts?

- Why was income summary not used in the dividends closing entry?

- My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

- This process shifts the balance of funds and effectively brings the closing balance to zero.

- Permanent (real) accounts are accounts that transfer balances to the next period and include balance sheet accounts, such as assets, liabilities, and stockholders’ equity.

- Steps 1 through 4 were covered in Analyzing and Recording Transactions and Steps 5 through 7 were covered in The Adjustment Process.

Companies are required to close their books at the end of each fiscal year so that they can prepare their annual financial statements and tax returns. However, most companies prepare monthly financial statements and close their books annually, so they have a clear picture of company performance during the year, and give users timely information to make decisions. Take note that closing entries are prepared only for temporary accounts. Revenue, expense, and dividends or withdrawals accounts are closed at the end of an accounting period. Opening entries, also known as initial entries, are made at the beginning of an accounting period.

Opening Entries in Accounting Ledgers

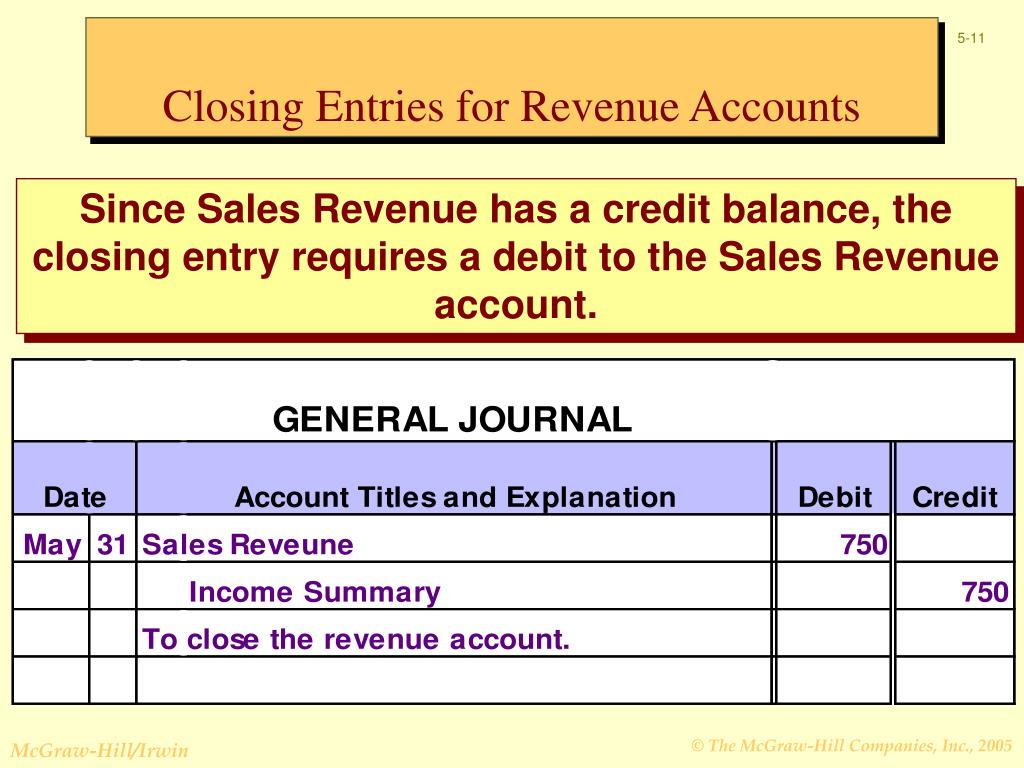

Free accounting templates can help you keep your journal entries in order and manage your bookkeeping in a straightforward manner. Debit each revenue account and credit the Income Summary account. Keep a comprehensive eye on your accounts every period with QuickBooks Online. Try it free today for your next accounting period and see the difference it makes. The T-account summary for Printing Plus after closing entries are journalized is presented in Figure 5.7.

These permanent files include assets, liabilities and equity sections making them very useful in showing the company’s financial position that lasts long. The balance in dividends, revenues and expenses would all be zero leaving only the permanent accounts for a post closing trial balance. The trial balance shows the ending balances of all asset, liability and equity accounts remaining. The main change from an adjusted trial balance is revenues, expenses, and dividends are all zero and their balances have been rolled into retained earnings. We do not need to show accounts with zero balances on the trial balances. Temporary (nominal) accounts are accounts that are closed at the end of each accounting period, and include income statement, dividends, and income summary accounts.

It lists the current balances in all your general ledger accounts. In this case, we can see the snapshot of the opening trial balance below. Temporary accounts include all revenue and expense accounts, and also withdrawal accounts of owner/s in the case of sole proprietorships and partnerships (dividends for corporations). All of Paul’s revenue or income accounts are debited and credited to the income summary account. This resets the income accounts to zero and prepares them for the next year.

The closing entry will credit Supplies Expense, Depreciation Expense–Equipment, Salaries Expense, and Utility Expense, and debit Income Summary. Other accounting software, such as Oracle’s PeopleSoft™, post closing entries to a special accounting period that keeps them separate from all of the other entries. So, even though the process today is slightly (or completely) different than it was in the days of manual paper systems, the basic process is still important to understand. The purpose of closing entries is to prepare the temporary accounts for the next accounting period. In other words, the income and expense accounts are «restarted».

If dividends are declared, to get a zero balance in the Dividends account, the entry will show a credit to Dividends and a debit to Retained Earnings. As you will learn in Corporation Accounting, there are three components to the declaration and payment of dividends. The first part is the date of declaration, which creates the obligation or liability to pay the dividend.

Your car, electronics, and furniture did not suddenly lose all their value, and unfortunately, you still have outstanding debt. Therefore, these accounts still have a balance in the new year, because they are not closed, and the balances are carried forward from December 31 to January 1 to start the new annual accounting period. As the drawings account is a contra equity account and not an expense account, it is closed to the capital account and not the income summary or retained earnings account. The purpose of the income summary is to show the net income (revenue less expenses) of the business in more detail before it becomes part of the retained earnings account balance.

A sole proprietor or partnership often uses a separate drawings account to record withdrawals of cash by the owners. Although the drawings account is not an income statement account, it is still classified as a temporary account and needs a closing journal entry to zero the balance for the next accounting period. Closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the retained earnings account. These permanent accounts form the foundation of your business’s balance sheet.