They include time spent doing administrative work and other tasks that the client can’t directly be billed for. Accountants calculate billable hours to bill clients for financial services, like preparing taxes, auditing, and consulting. It helps build transparent client relationships, invoice accurately, and assess profitability. When considering the realities of working in a law firm, it’s important to understand how much of your time you can realistically bill to clients. Non-billable time isn’t wasted — these activities are essential for running a successful practice and developing your skills as a lawyer.

How do you calculate billable utilization?

The employer can cut contracted hours only if this action is in accordance with the employment contract terms or if the employee has been consulted and agrees to the change. Employers must pay for the contracted hours regardless of work volume. Paying less than the contracted hours can violate employment contracts unless specified situations, like deductions, have been agreed upon. A company can identify activities, like excessive administrative tasks, that consume more hours than necessary, thus pinpointing opportunities to streamline processes and enhance efficiency.

How confident are you in your long term financial plan?

Tracking the number of hours worked can help ensure that clients are billed accurately for the time spent on their projects and can avoid misunderstandings or overcharges. Non-billable hours can be used to develop the skills and knowledge of employees. These activities include job training, attending conferences, or participating in team-building exercises that enhance employees’ professional development.

- Finally, multiplying the rounded decimal hours by your hourly rate determines the fee.

- Attorneys often round up to the nearest allowable increment to ensure they are compensated for the total time spent on a task.

- Tracking billable hours also generates transparent client invoices to help build trust.

- Making sure the pay rate per hour aligns with the goals for profitability is very important for keeping business growth going.

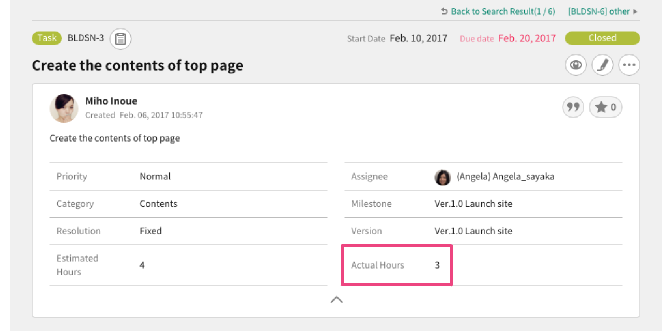

What are billable hours vs actual hours?

Timesheets can track useful and practical information concerning the hours that go into the completion of a project, and whether that project brought the expected results or not. To maximize on an attorney’s billable hours, some law practices resort to increasing their overall work hours to upward of 70 or 80 hours per week. Time trackers like Time Miner can be integrated into your communication app to track how much time is being spent on calls, text messages, and meetings. Building contractors and freelancers, for example, could be said to work something akin to billable hours on a daily basis. The term “billable hours” can sometimes cause confusion because people in many different professions charge by the hour for their work through invoicing. One very important part of managing a business efficiently is regularly reviewing and adjusting rates.

Factors influencing billable hours

It’s beneficial for the company to be able to monitor employee performance. Tracking billable hours in conjunction with other workforce management metrics can help management assess who their top performers are. It also means that you can use data about previous billable hours that your company has invoiced to provide accurate estimates for any new work that clients would like your organization to do. Remember, tracking attendance along with information on the pay rate per hour helps prevent overpayment issues.

The client has agreed to pay $150 per hour for consulting services. Time tracking software automatically records hours with simple start/stop timers. The idea is to maximize billable client hours while minimizing non-billable operational overhead.

In this example, charging at least $219 per hour will cover your salary, overhead, and desired profit margin. Adding these expenses together, your total monthly overhead would be approximately $9,400.

The optimal balance reached through these steps makes sure the use of billable hours is maximized. It aligns with the agency’s tax extension working protocol with its monetary prospects. Project management tools like Asana help improve a company’s productivity.

Mistakes in these areas can lead to lost revenue or disagreements that hurt a company’s profits. The quantity of billable client hours logged and the company’s hourly rate will determine the total charge to the client. Higher billable utilization generally signals more revenue-generating work. Billable and actual hours refer to the time spent on billable projects and non-billable tasks respectively. Actual hours refer to the total number of hours worked by employees in a given period, as recorded and documented by the organization.